Mortgage Rate Forecasting: What Realtors Need to Know for 2025

Confused about when mortgage rates will finally drop? In this episode of The Texas Real Estate & Finance Podcast, we dive deep into Mortgage Rate Forecasting for 2025. Mike Mills sits down with Kendall Garrison, CEO of Amplify Credit Union, to break down the Fed’s recent rate decision, bond market signals, and how inflation, debt, and tariffs are shaping the future of housing. You’ll also hear why fee-free banking matters and how Realtors can guide clients with smart, long-term strategies. Packed with timely insights, this episode is a must-listen for any real estate professional navigating today’s economic uncertainty.

Confused about when mortgage rates will finally drop? You're not alone—and this episode brings the answers. Kendall Garrison, CEO of Amplify Credit Union, joins Mike Mills to unpack what the Fed’s latest decision means for interest rates, real estate professionals, and your clients’ wallets.

🎯 Episode Overview

Mortgage Rate Forecasting is top of mind for Realtors in 2025—and in this data-packed episode, we’re giving you the insights you’ve been waiting for.

Mike Mills sits down with Kendall Garrison, CEO of Amplify Credit Union, to discuss the Federal Reserve’s recent decision not to cut rates, and what that signals for the housing market going forward. Together, they break down what real estate professionals need to understand about:

- The real reason mortgage rates haven’t dropped

- How the bond market and inflation data are shaping 2025 predictions

- The surprising relationship between national debt, tariffs, and homebuyer affordability

- Why fee-free banking is a game-changer for consumers and small businesses

- A long-term wealth strategy Realtors can share with clients now

This is a must-listen if you're helping clients navigate rising costs, economic uncertainty, or struggling to make sense of rate volatility. By the end of the episode, you’ll walk away with actionable insights to use in conversations with buyers, sellers, and referral partners.

💡 Key Takeaways

📈 Why the Fed Isn’t Cutting Rates Yet

Kendall explains that inflation data—not just unemployment or GDP—is the primary driver behind the Fed's decisions. Mortgage rates may not move until inflation hits a more consistent decline.

🏦 How the Bond Market Controls Mortgage Rates

Realtors often assume the Fed directly sets mortgage rates, but Kendall breaks down how the 10-year Treasury yield, investor sentiment, and global factors drive the mortgage-backed securities market.

💰 National Debt and Housing Affordability

Rising U.S. debt means higher borrowing costs and unpredictable fiscal policies, which can push rates even higher. Kendall shares how this macro factor trickles down to affordability at the neighborhood level.

🚫 Why Amplify Went Fee-Free

In a bold move, Amplify Credit Union eliminated deposit account fees—something Kendall calls a moral and strategic imperative to support those most affected by traditional banking models.

🏠 Real Estate Is Still a Long Game

Despite market noise, Kendall reaffirms the power of real estate for long-term wealth—highlighting why buying, holding, and refinancing over time is still one of the smartest financial plays.

📚 Resources from This Episode

🔗 Podcast Website:

https://www.thetexasrealestateandfinancepodcast.com

🔗 Host Linktree:

https://linktr.ee/mikemillsmortgage

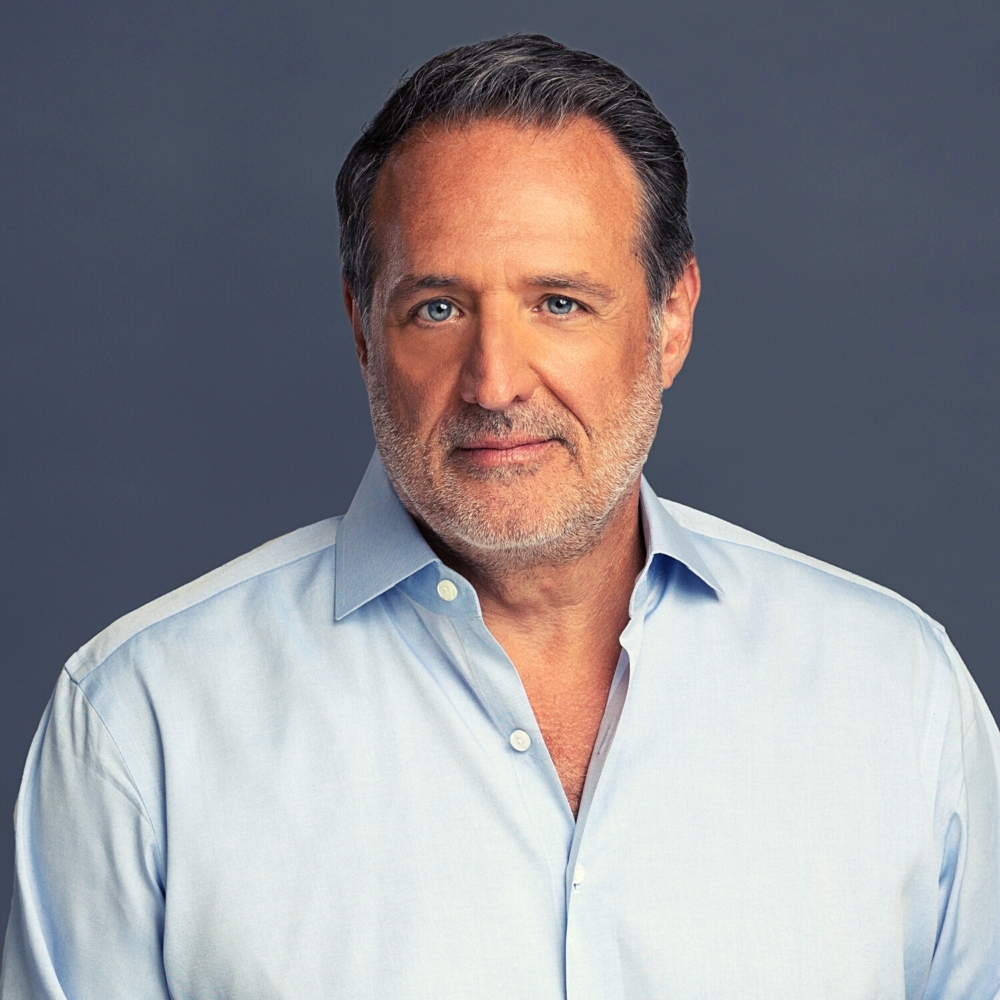

🎙️ Guest: Kendall Garrison

- Title: Chief Executive Officer, Amplify Credit Union

- Email: ceo@goamplify.com

- LinkedIn: https://www.linkedin.com/in/kendallgarrison/

- Company Website: https://www.goamplify.com

- YouTube Channel: https://www.youtube.com/@amplifycu

✅ Enjoying the podcast?

Make sure to subscribe, leave a review, and share this episode with a fellow real estate pro. It helps us bring more powerful insights to your business—and your clients.

00:00 - Untitled

00:17 - The Refi Boom: A Double-Edged Sword

06:05 - Economic Uncertainty and Job Market Trends

09:33 - The Impact of Economic Trends on Housing and Mortgages

15:56 - The National Debt and Its Implications

23:04 - Economic Implications of Tariffs and Tax Cuts

29:00 - The Impact of Tariffs on Trade and Manufacturing

36:59 - The Impact of Tariffs on Housing

41:43 - Understanding Homeownership and Affordability

49:20 - Rethinking Banking Fees and Consumer Impact

52:52 - Navigating Challenges in the Mortgage and Real Estate Business

Kendall Garrison

When the world was flooded with liquidity, that was the thing that drove rates to zero. I certainly remember.I'm going to choose to call them the good old days, but in some ways they were the bad old days because it was sending home prices soaring through the roof, especially in places like Austin.It was also giving our real estate teams, our processing teams, closers, funders, post closers, the opportunity to work about 90 hours a week because it was the greatest refi boom mankind has ever seen.

Mike Mills

Yep. Nice. It was so nice.

Kendall Garrison

And so it was a, it was a sword that cut both ways, though. But I, I don't think we're going to see that again for a really long time, if ever.

Mike Mills

Hello, everybody. Welcome back to the Texas Real Estate and Finance Podcast. I'm your host, Mike Mills, a local North Texas mortgage banker with Service First Mortgage.And today's guest is truly someone who understands the intersection of financial policy, mortgage lending and real estate strategy. And that is Mr. Kendall Garrison, the CEO of Amplify Credit Union, and that is based right here in Austin, Texas.And under his leadership, Amplify has become the first 100% fee free banking institution in Texas. And that's kind of setting a new standard for transparency and member, member first service for everybody in the industry.And Kendall himself brings decades of experience in finance, lending and economic forecasting.And so today we're going to dig into how all that is going to impact interest rates, your clients and everything else that we're dealing with in this crazy market that we're handling right now. So, so, Kendyl, obviously welcome to the show, but I do want to kind of get things off right out of the gate.So yesterday we obviously had more news that the Fed decided again that they are not going to cut interest rates, keeping it around that 5.25 to 5 and a half percent. And that's where it's been basically since July of 2023. So this is basically the seventh straight meeting in a row without a cut.And you know, many in the banking and mortgage industry obviously want that to happen, but it doesn't feel like it's going to happen. At least certainly not this time. We'll have to see.There were two dissenters that decided that felt like, you know, they should have cut, that didn't. So. But the majority rules in that case. So tell me your thoughts on this, on this recent decision and what you think about it.

Kendall Garrison

Well, first, thanks for having me. I'm really glad to be here to cover, to cover some ground.On the last day of July of 2025, the year's slipping by, but I think yesterday's Fed decision was really quite, quite unsurprising. You know, Jay Powell has, has displayed a great deal of caution.I think that he was really, really, really stung by inflation that was thought to be transitory and turned out to be a real thing, and then had to, had to backpedal as fast as he could to raise rates. And the thing he doesn't want to let happen is to, to see inflation return, or at least not continue to cool off.And it popped up 0.1% higher today than was originally projected.So even though there were some dissenters in the voting, members of the Fed Board of Governors, I think that there is just so much uncertainty in today's marketplace. You know, there is continuing challenges on the consumer credit front as we see the economy start to weaken.I think jobs aren't quite as strong as people think they are. The stock market is on fire, and that feels a bit like irrational exuberance, as they say.The impact of tariffs are yet unknown and will very clearly be inflationary if they come to pass in the manner that they've been discussed. And so I think the Fed is going to be really, really cautious. And is there a cut in September? Maybe, maybe not.But at the end of the day, my worldview is that predicting the direction of rates is a fool's errand. The professionals that choose the direction of rates, if you look at the dot plot, they're only right about 22% of the time.

Mike Mills

Right.

Kendall Garrison

And so for guys like me who are really a practitioner and not, and.

Mike Mills

Not a theoretical, theoretical, not a prognosticator.

Kendall Garrison

Yeah, we're not, we're not going to play that game. We're going to be prepared to react in a rates up or rates down environment.But I will tell you that my colleagues and I are extremely tired of higher for longer.

Mike Mills

So, hey, we're all in the same boat. Yes, yes. Well, so I, I want to ask you, you know, because this is my opinion, but I mean, I think a lot of people feel this way.It's, it's kind of like we have several different economies going on at once. Right. We, we chatted about this a little bit before we came on, but, you know, you've been doing this for a very long time.And so especially being in banking, you know, we, you're tracking where things are going overall. And, and typically what we see is stock market goes down, jobs get worse, you know, spending gets cut, and we get into recessionary period.And then Something happens, we loosen stuff up a little bit, stock market goes up, jobs get better, we're in a growing economy and you know, everything's back up.So always since we've been tracking this stuff, it seems like everything goes down, everything comes back up, everything goes down, everything comes back up.But right now we're in a place where GDP keeps growing, which I still think is a questionable metric on the healthy of the economy, but whatever, GDP keeps growing, jobs are getting cut, right? And we're seeing massive amounts of job cuts.And the only growth that we're seeing are in government sectors and in health care, which not to say that we don't need health care workers because we absolutely do. But when the majority of your employment is, is, is healthcare workers, what does that say about the health of your society? That's a little scary.But.But then at the same time the stock market's hitting all new highs, Crypto's going through the roof and yet the average person is, is shrinking their spending.Companies like Amazon and Walmart and Target and the average, you know, on the street stores where people spend their money are showing down years, down quarters, housing is down. So, so why do we have, you know, the highest stock market, highest crypto, low housing, low jobs, and yet growth in gdp?And so it's like depending on what numbers, what numbers you're looking at, that tells you if the economy is good or bad, but it seems to be both.

Kendall Garrison

It does seem to be both. And so it feels like certainly in segments of the economy we're in a recession.I think, I think we are certainly in a housing industry recession the likes of which we have not seen since the housing recession, you know, in 2009.And so that is really driven by the lack of affordability and you know, the median home price in Texas, and it varies obviously by which market you're in, is just off of its all time high. And that compounded with, you know, mortgage rates in the 7%, 6 and a half, 7% neighborhood really are killing housing.There still is plenty of demand, but there is no affordable inventory to buy. And I think also consumers still have sticker shock on interest rates and they remember the good old days of three years ago or four years ago.I remember those days too, right here where I'm sitting in my home, I have a 15 year, 2 and 3/8% mortgage that I'm deeply, deeply in love with. And so that's locked me into, locked me into where I live.And so it is really an interesting time to be in the in the real estate business or the mortgage business. But then you look at some other segments of the economy and they're going gangbusters.There is still plenty of great retail, and if you look at commercial real estate that is supported by retail and industrial, those segments remain extremely hot. And valuations and cap rates really are pretty impressive in those segments, if you're looking at real estate.But you're right, we see tech job cuts and we feel that acutely here in Austin as we've seen Meta and Cisco and Google and indeed a whole host of technology related companies pretty dramatically slash staff here. And so for the last five years, since the beginning of COVID nothing in the economy has worked the way it had for the previous 50 years.And so there were really traditional levers, you see, you know, stock prices go up, bond prices go down, and, and, and so that traditional interplay between the various financial markets just doesn't work well anymore.

Mike Mills

Right, yeah, it's, it's, I mean, look, again, we talked about this before we started the show, but when you pump, you know, trillions of dollars into the economy and, and drop a helicopter of cash onto society, it's going to have some very unexpected repercussions or, you know, maybe expected, I don't know. But, but either way, it's, it's not right.And you know, when you look at, when you talk about the rates of Yesteryear, right, the 2 and 3%, you know, I, I tell my clients all the time and I tell agents all the time, I'm like, listen, that in my opinion, is never coming back.The only way that it ever comes back is if we ever get into a situation like that and we jump trillions of dollars on the economy and push that that way. So, so I want you to, you know, explain like we're all sixth graders, the, the interplay because, you know, I know you experienced this.I experienced this. When the Fed does cut rates, whenever that happens, the first question will be, well, okay, well, mortgage rates should come down.And my answer to that is always, well, no, not necessarily. And, and there's reasons behind that.So I want you to chat a little bit about, you know, why rates got to that 2% mark and then why even with the Fed cutting rates, because of the debt that we're in in the US in the US Government, why it's not necessarily a done deal that mortgage rates will also come down as well.

Kendall Garrison

So there are a lot of questions in there. So I'll try to take those one at a time. The first one I think from a historical perspective is why did mortgage rates go to 2%, 2 and a half percent.So they, they dropped that far really for two reasons. Number one, the Fed essentially cut the overnight rate to zero and left it there for far too long. And so that is the indicator of the risk free rate.And so when the risk free rate is zero to take a little risk and you're getting 200 basis points or 300 basis points above that, that feels like a pretty good way to earn some income. And so it's funny because a lot of people think that interest rates are pegged to the ten year Treasury.They moved in lockstep for a long time, but over the last three or four years, 30 year fixed rate product has been decoupled from the 10 year and it doesn't move in the same sink and with the same spreads that it did at one point in time.But you know, there are a lot of people in the world that think that mortgage bankers set rates, that banks set rates, that credit unions set rates, and that's not actually true. Who sets rates are the ultimate loan buyers.And so if you look at, you know, every loan that's originated, every real estate loan, whether it is an agency eligible product or if it's a non QM product, is originally, well, it's originated to be securitized and sold into the secondary market as an investment for whomever, for hedge funds, for insurance companies, whomever buys non QM mortgage backed securities.

Mike Mills

Well, and on that point too, I don't know that a lot of people understand that when you look at, and it's not always non qm, it's other things, but pensions and state funded, we're talking billions and billions of dollars in these government or I should say publicly managed pension funds. That's where these invest, that's who these investors are. Right.So your, your pension and your retirement and your Social Security to some extent these are all tied into the market because they have to have growth in order to pay those things out. And these are the, these are the, the most safe, you know, you could say instruments that they can use to do that.

Kendall Garrison

Yeah. And so, and so the way the way rates are really set is they're set by what the long term investors will pay for those mortgage backed securities.And then of course the originators have to put their margin on top of that and then they have to build in their hedge cost in case interest rates go up or down. And so it is really ultimately the secondary market that sets rates.And so when the treasury dumped $5 trillion into the economy at the beginning of COVID it flooded the world with liquidity.There was so much liquidity, there was so much cash looking for a way to earn some sort of return that it essentially it was a race to the bottom on what investors would pay because they have maturities.So if you're CalPERS, the California Public Employees Retirement System, and you're managing $4 trillion in assets, your churn every month is in the hundreds of millions of dollars that you have to reinvest and put back to work.And leaving it in cash with virtually a zero return is a heck of a lot attractive than buying mortgage backed securities with a two and a half percent pass through rate, which is a 3% mortgage. Right.And so when the world was flooded with liquidity, liquidity, that was the thing that drove rates to zero and, or as close to zero as you can get. And I certainly remember I'm going to choose to call them the good old days.But in some ways they were the bad old days because it was sending home prices soaring through the roof, especially in places like Austin.And it was also giving our real estate teams, our processing teams, closers, funders, post closers, the opportunity to work about 90 hours a week because it was the greatest refi boom mankind has ever seen.

Mike Mills

Nice. It was so nice.

Kendall Garrison

It was a sword that cut both ways though. But I don't think we're going to see that again for a really long time, if ever.

Mike Mills

Yeah, and the other part of that too is, you know, I want to talk a little bit about the, the national debt and where we have gotten with, with spending because you're right, there has been over the last couple years a decoupling between the direct correlation between the treasury yield and mortgage backed securities yields. But either way they still compete with each other on the secondary market onto, onto who's buying what.So you know, when, when the government spends money that they don't make in or take in that we have, and operated a deficit, which we have, I mean, pretty sure as long as I've been alive almost, then they have to raise money somewhere. And so in order to get that money they have to sell Treasuries and they have different ones that they could sell.But the 10 year treasury is the one that most closely ties to mortgages. And so when the demand for that declines because we have so much debt, the government has to raise the yields on those.Well, we have to give more in order to get investors attracted into buying that.Well, when that happens, then the Mortgage backed securities also have to have a greater yield in order to attract investors into them because like you said, in the secondary market, that's where people are trying to invest their money and you've got to decide where to put it. So in order to make mortgage backed securities more appealing, got to have a bigger yield there too.So, so then we get into this situation where even if the Fed does show up in September and says we're going to cut rates a quarter of a point, the Fed funds rate doesn't necessarily correlate to what's going to happen with mortgage rates because as long as that debt keeps piling up and we keep spending more than we're making, then, you know, how do, how do mortgage rates come down?

Kendall Garrison

So that, that is actually the real challenge over time.And so you'll remember a year ago when the Fed cut rates by 50 basis points, we were high five surviving each other because we saw 10 year treasury yields drop by, I can't Remember exactly, maybe 75 basis points and then turned around and right back up over the course of the next three weeks to a level that were actually higher than they were before the Fed rate cut. And so you're exactly right. It's a function of the deficit. Year to date, we are running at the federal level a $2.7 trillion deficit.That's in one year.Our total deficit for the US government now approaches $34 trillion, a number that is essentially unimaginable to the average person as to what their individual share of that public debt is.

Mike Mills

Right.

Kendall Garrison

17% of the U.S. government's budget is interest on the debt.

Mike Mills

Yeah. It's exceeded defense spending. Right. And it has, has it, has it passed Social Security yet?

Kendall Garrison

It has passed. Entitlement is the largest individual line item.

Mike Mills

Okay.

Kendall Garrison

In the, in the federal budget. That was, that's my recollection when I looked last.

Mike Mills

Yeah.

Kendall Garrison

And so as long as we continue to issue additional debt at this rate, I'm not sure that the US Government will ever, not ever not operate in a non deficit status. But we cannot continue to spend at this rate. And you know, you can't necessarily cut your way to greatness, as they say.And so cutting spending is part of the answer, but it's not the only answer.

Mike Mills

Right, right.Well, and that's where maybe the, the tariff discussion comes into it a little bit because you know, obviously with the big beautiful bill that they just passed, the idea behind it, I mean you can, I hate bills like this anyway because there's, there's 8 billion different pieces to it. And it's like it's either a yes or a no.And it's kind of like you're voting yes or no on 50 different things or 100 different things that you agree with or don't agree with, but whatever. So you can argue that all day long. But the point was, is it passed.And the idea, at least from the Trump administration's point of view, was that we're going to help cut the deficit by growth. We're going to grow. Right.We're going to, we're going to grow our gdp, we're going to take in more revenue and therefore, even if our spending stays high, we'll be able to cut the deficit. Still remains to be seen.But I will say, according to what I read for the month of June, they actually had the first surplus in revenue compared to spending for that month. Now that continues in that much of that had to do with tariffs on what they were taking in.The problem with tariffs though is again, you get into this double edged sword of we know right now because at least they've said that a lot of companies are eating the, the, the expense on the tariffs right now because consumer spending is so low anyway that they don't want to push it even further. So, so then when you look at what tariffs can do to inflationary issues, but what it might also do to bringing in revenue, what's the balance there?And then do you like, what are your general thoughts on if you think that that's even a viable option for us in reality?

Kendall Garrison

So a couple of thoughts some of your viewers may recall may be as old as I am and recall the Reagan presidency in the 1980s when, when he wanted to sell trickle down economics, which is lowering tax rates on the highest end of the spectrum would drive investment to the economy and grow the economy. Guess what? It didn't work then. Guess what? It's not going to work now.

Mike Mills

Yes.

Kendall Garrison

And so that is just really a tax cut for rich people and an increased tax burden for the rest of us. Yeah. And, and so I think the tax cuts, I mean, I'm sure they feel great to some people and they certainly feel great to corporations.They, because they have the lowest nominal tax rate that they've had in, you know, probably 75 years.

Mike Mills

Yeah.

Kendall Garrison

And, and so, but that doesn't really actually build the economy over the long time, long term. And it doesn't address the ever growing federal debt that we have. And so growing federal debt is ultimately inflationary.It sucks some of all the air out of the economy and that in and of itself will drive rates up. Just as you said, we have to pay more on our government debt to attract the buyers for that.And so the largest buyers of government debt in the world are Japan is number one, China is number two. Don't start a trade war with someone that can actually cause you some real damage by dumping your bonds or not continuing to buy them.Yeah, so, so that, that is an economic challenge from my point of view. You know, the other part of it is tariffs.And anybody that watched Ferris Bueller's Day off will recall the great description of the Smoot Hawley act and what Tarif did to the economy in the 1920s. Okay, so.

Mike Mills

YouTube. Yes. Yes. Anyone? Anyone?

Kendall Garrison

Anyone? Yeah, so it's actually a must watch and describes in, in, in, in great detail what happens with tariffs. Tariffs are ultimately inflationary.Inflationary pressures will drive up interest rates. That's just the way the world works.

Mike Mills

Yeah.

Kendall Garrison

You heard me refer to the risk free rate, which is what you refer to as treasury yields. A Treasury yield is made up of two things. Number one is duration.So the longer the term of the treasury bill or bond, the higher interest rate it carries and you take that and you add it on top of whatever the inflation rate is and that gives you your risk free rate. And so if you have inflation in the economy, rates are going to be, continue to be driven up. Yes.Today companies are sitting on their hands and are not passing tariffs through depending on the segment.

Mike Mills

Right.

Kendall Garrison

Not everybody lower end consumer goods, they're not passing those costs on to the ultimate consumer. But if you've ever spent any time in your life studying the economics of companies like Walmart, I can trust you.They are not going to let their margins get crushed over the long term.And so they might not move at 30% overnight or at 50% overnight, but they'll chip away at it at 3, 5, 7% a month until they actually get their margins back.They're already operating in fairly low margin businesses and they're not going to sacrifice that because of, because of tariffs that are in the economy. Tariffs aren't paid by some nebulous unknown foreign country, they're paid by the end use buyer.Yeah, and I'm really afraid that those tariffs are going to fall most acutely on the people who can least afford to pay them.

Mike Mills

Yeah, well and it's like we have two economies, right? We have the economy for one segment of the population that has a lot of wealth and concentration.We have the economy for everybody else which is like 90% of the rest of us and the. I think we've always, or not we.I feel like the federal government has always operated in this world of, well, if we just give the people with all the money less expenses, then they will let everybody else share in that by either cutting prices or reducing costs or, or whatever the case, creating jobs. Like that's always been the theory, right? And that's, that's always been this economic theory that's existed.But the problem is, and I don't believe necessarily in a cabal of, you know, people sitting in a room deciding, you know, we're gonna squash the little guy. I don't think that that's necessarily the case. But all you have to do is look at incentives and structures, right?So our entire stock market is based on a public publicly traded entity, a corporation that the board of directors has a fiduciary responsibility to its investors to turn a profit and to grow that company every single year.So if you're, if your goal and your job is to raise the profit margin and raise your share price at no stop ever, because we just always go up, up, up.You're not ever allowed to go down, then under no circumstances, if there's a government tax break for a corporation and is that money going to then be not eventually passed on or kept by the, by the shareholders in order to increase the share price because you're giving them a free out, say, hey, we're going to reduce your expenses over here, less taxes, less whatever. And so now your share prices go up. It's not going to be pass the consumer.But then when we get additional costs like tariffs that come in for goods, then we, we're going to expect those same people to then turn around and say, oh no, no, no, we're going to keep those, we're not going to pass it on. No, it's because of the structure. They have to make money. That's what they're required to do.So to think that that's just going to, that people are just going to operate from, well, they're going to be good humans and just decide to pass that along, I think is so naive. But yet we've operated under that assumption for 40 years. I don't, I don't understand that.

Kendall Garrison

So if you'll indulge me here for a minute, I can give you a very real world example. So back about 10 or 12 years ago, a thing was passed in Washington called the Durbin amendment, okay?And the Durbin amendment limited interchange income. And if you don't know what interchange income is and most civilians don't, it's this really inside.So every time you use your debit card or your credit card to pay for a thing at your local grocery store or gas, when you fill up your car or whatever, whenever you swipe your debit card or credit card, the merchant pays a small fee to the issuer of that credit card or debit card.

Mike Mills

Right.

Kendall Garrison

In order to facilitate the transaction, to let it go through the visa or the MasterCard, rails or the Discover Rails or however, how they make money. That's how financial institutions make money. Yeah, it's a tiny, a tiny amount. It's 15 or 20 cents at a swipe. It's not, not huge money.So the Durbin amendment limited the amount of interchange that banks, over $10 billion in assets could earn on each transaction.

Mike Mills

Okay.

Kendall Garrison

The merchants were screaming and they said, hey, we're going to, we're paying all of these fees to banks to facilitate payments. They make too much money. There should be a cap on it and it will be good for the consumer at the end of the day. Guess what? No surprise.They didn't pass the savings on to the consumer. It just boosted their margins.

Mike Mills

Yes.

Kendall Garrison

And that's exactly what's going to happen with tariffs over the long run.

Mike Mills

Yeah.

Kendall Garrison

Not overnight.

Mike Mills

No, but over time. Well, and there's also another assumption inside the tariffs or the people that argue for them.And honestly, I, I, I don't know enough about it to say that I believe this or that in one way or the other. I know what this side thinks. I know what this side thinks. And I think eventually, you know, we'll, we'll see how it plays out.But one of the other assumptions in there is like, well, if we raise the cost to purchase something from China or from Japan or from wherever, then those companies will then buy more products made in America, which then will generate more jobs and so on and so forth. And that sounds awesome, except for the fact that we don't produce anything in the United States.We make, we make money and we make weapons and, you know, maybe we have a certain impact on corn making in, on the farms, you know, I mean, or soy or whatever. Like, like that, that's it. Like, we don't produce things here.Now they're starting, you know, companies have pledged they're going to build factories. Elon's, you know, obviously in Austin building car manufacturing there.But this is automated, so you're not creating a ton of jobs there because, I mean, I love Elon, but, you know, it's it's not like he's booming the city of Austin because he built a factory there other than maybe some tax based stuff.But, but either way, that's the assumption is, oh well, now you know, companies are going to be forced because it's going to be cheaper to buy things here and then we're going to produce more stuff. But we don't have the infrastructure to do that, nor have we had that for 30 years to produce any kind of level of manufacturing.So, so why, why are people, so why do they buy into that argument as well? I don't understand that. So am I missing something?

Kendall Garrison

I don't think you are missing anything. And so what tariffs do is they don't eliminate the demand for products. Okay? But what they do is rearrange trade arrangements.So if a thing is made in China and there's a 50% tariff on it, companies like Foxconn, the giant electronics contract manufacturer, will simply shift their production to factories that they already own, own in Vietnam or in Indonesia that only have a 30 or a 20% tariff rate. And so you're just going to rearrange the, the, the trade routes and the trade partnerships that you have.You know, you see all over the news, if we were going to build an iPhone in the U.S. it would cost 2,500 bucks or whatever. That's great. Number one, nobody wants to buy a $2,500 iPhone.And number two, they don't want to wait five years for the infrastructure to be built in order to produce that $2,500 iPhone in the U.S. the other thing, that is a challenge.Since 2001, we have seen manufacturing jobs in the U.S. decrease from about 19,000 manufacturer, I'm sorry, 19 million manufacturing jobs to now less than 12 million manufacturing jobs. So we don't have the skilled labor to be able to do that.We don't make things, we think things and we have turned into a knowledge economy as opposed to a, a manufacturing economy.

Mike Mills

Right.

Kendall Garrison

And, and I, I don't, I don't think that is going to, to come back. And you know, the other thing is, if you look at the 2018 tariffs, I spend a lot of time on tariffs. I'm sorry, but that's just the way.

Mike Mills

No, I, I, I mean it's, it, it impacts, it's, it's a very topical thing that's going on right now. And I think the average person doesn't understand because we don't.Look, I always tell people when it comes to buying houses, right, because they'll call Me with simple questions like, I know this is a dumb question. Like, it's not a dumb question because you don't do this, right? You don't buy a house but once every seven or eight years, right? That, that's it.So for, for me as a person that does it every day, to expect you to understand the ins and outs of how it works is unreasonable. And so as general citizens of the United States, we have jobs, we have kids, we have responsibilities, we have so many things going on in our lives.To understand how terrorists work, other than a sound bite that you hear from your favorite news commentator or your favorite Twitter person or whatever that tells you, okay, well, that must be the answer. It's like, well, that's what they think and you don't know what their agenda is and what they're actually behind it.But until you understand what it really impacts, you don't really know. When you say, oh, I'm for tariffs or I'm against it, you don't know what that means. Like you think you do, but you really don't.

Kendall Garrison

So, you know, a prime example of tariffs not working the way you think they should is the 2018 steel tariffs. So we put in tariffs on steel for auto manufacturers. Here's the cool thing, about 8,700 jobs in the steel industry were created by those tariffs.Oh, here's the unintended consequence. We lost about 40,000 jobs in other manufacturing, like auto manufacturing.And the last of the appliances that were made in the US no longer are because of the imported steel tariffs. And so we gained 8,700 jobs. We gave away 40,000 jobs.And so it is always the law of unintended consequences when you try to impact at a macro level, economic policy. It's, it's, it's never the panacea that it has that it is made out to be.

Mike Mills

Well, and, and it also starts bleeding into, you know, housing. Because the, the only way to fix, in my opinion, the only way to fix housing is regardless of sellers aren't going to hear this.Me, who owns my house has gone up in tremendous value. Is not gonna, doesn't like the idea of this necessarily, but it's. The truth is we need more housing.We still have to build more housing because it has to come down. The only way to get. When, when the first time home buyer average age goes from 28 or whatever it was to 38 in like 10 years. That's not good, right?There's a lot of problems there. The average homeowner is 55 years old. Like we, there has to be a transition. People aren't having kids is at the same rate they have.They're not getting married because they can't afford so many things, right?So, so when you look at, you know, I always joke because people will say, oh, well, millennials and, and gen zers, you know, they want to travel and they want to do all these other things, and so they're more transient and they don't really want to own a home.I'm like, okay, I mean, maybe when you're 25, but when you have a baby and you get married and you want to settle in and have a school, yet you absolutely want to own a home. Like, you don't want to live in an apartment. And I mean, some people do in New York City or whatever, but that's not typical.So, so it's, it's, it's something that, with the way that everything has become so expensive, the only way that you can get housing in particular down is to build more homes.Well, in order to build more homes, we have to have cheaper goods, we have to have more labor, we have to have, you know, everything be declined on the cost to build a home. So every house that isn't built or that is built doesn't have a 3, 200 square foot footprint.And you can build affordable smaller homes in neighborhoods with less cost.But if, if those things don't change and we stay on the tariff route and we stay on the, you know, not having enough people, whatever that means route, then it's going to be challenging to bring that down without subsidies and more costs, which is just another tax on us. Tariffs are a tax on the individual. Taxes are attacks on us. You know, subsidies are a tax on us.But hell, we subsidize, subsidize a lot of other things. Why can't we subsidize housing?

Kendall Garrison

So, you know, it's interesting.The thing that a lot of people don't see in places like Austin, the administrative and bureaucratic burden on a new build is really unfathomable to most people. So in Austin, you've got about $90,000 worth of admin costs in the form of permitting and environmental and additional infrastructure.You know, we have a program called Affordability Unlocked where you either set aside a certain amount of these units for low to moderate income people, or you just pay the city of Austin a fee and you can go build whatever you want and you can build it at higher density. So it is, it really is interesting to see the bureaucratic and admin burden that we see on new builds.And the reason that amplified Credit union is in the mortgage banking business. We're in the retail direct, we're in wholesale mortgage banking.Those are the businesses that we focus on is because this is a little known fact that the median net worth of a homeowner is 40 times greater than that of a non homeowner. And so we as a not for profit financial cooperative exists to improve the financial well being of our customers members.What better way to do that than to get them homeownership ready to help them get into their first house or their second house or their move up third, fourth, fifth house. Because that is the way obviously your, your, your viewers know this, that is the way to build generational wealth.And so that's the reason we have chosen to focus on this business. It's not really fun right now. This is a tough time in the mortgage and the real estate business.But we think it's the right business and we're going to stay the course and continue to do what we do and do it in the way that we know how to do it and do it for the right reasons.

Mike Mills

So yeah, well, and it's funny too, you have a lot of nowadays because we're in the social media age, there's a lot of influencers that exist that are, you know, money gurus and everything else.And, and they will tell you that owning a house is, is, is, is a trap, you know, and they'll focus on the interest that you get for that you pay on 30 years and, and, and how that applies to it and, and how you should put your money somewhere else and all of these things. And to some extent you can argue that some of those points are correct.However the problem that that always gets missed is, is that the, the ability for the average person to go buy an investment property, the ability for an average person to invest heavily in the stock market or start a business or get money enough to do that is very challenging for a number of reasons.And it covers whether it be just access from where you were raised, whether it be, you know, your, your lack of understanding of financial, you know, models growing up and having bad credit, not knowing how to manage your money very well or whatever, like there's a million reasons but, but ultimately that is a very high barrier of entry to a lot of people. It's not just something you can turn over.However, buying a home that you're going to live in with your family is a low barrier to entry way to purchase an asset of a kind. You can call it an asset, you call liability, whatever, but that is going to appreciate in value. It is something that you're going to own.One of the few things that the average consumer will own that's going to appreciate in value because it has for the history of homes, right?So if you don't have the ability to buy a business and run it because you're, you know, working your 9 to 5 job and got three kids, or you don't have enough money to invest in the stock market and buy Nvidia, or you don't have enough money to, to purchase an investment home because you don't even own your own home, then that, that's not possible.So now we're trying to help people because it's always been the case in the United States, you know, used to be in the 50s and 60s, in the good old days, one income could pay for a home or a car and one person could work and one person could stay home and raise the family. And, you know, you see the repercussions of the, the generation that came from that.And now we have, you know, households that either have both parents working or we have households that don't even have two parents. And the kids are kind of left of their own devices to be, you know, and now we've got these phones that sit in front of us all day.So there's a whole other realm of world that's educating us and we're not able to start that process of owning a home. And then now you're also being told ads, it's a racket. Any, you shouldn't do it regardless. Okay, so, so what do you, what are your thoughts on that?When you see that kind of stuff and knowing what you know and what you just said, what do you think about that?

Kendall Garrison

So, you know, I think a couple of things with respect to affordability. It's not just housing costs and it's not just where interest rates are. There are some other components that really drive affordability.So the cost of a commute, if you have to live an hour and a half away from wherever you go to work, there's a cost to that. There's a cost to your life. There's an actual true monetary cost. The cost of daycare.If both parents have to work and your kid is in daycare and it costs you 12 or 1500 bucks a month per kid, you think about that family tax that's put on you, and that is an additional burden that young families and young homeowners have to, to deal with. So I think that from a policy perspective, we've got to address affordability across the board, not just affordability and housing.So I think there are plenty of other things that come into play.You know, the other point is that influencers that say homeownership is a scam, that's a generalization and all generalizations are false, including that one. And so I would say that yeah, there are some circumstances where you're better to be a renter.And yes, there are some circumstances where you don't treat your, your, your primary residence as an investment. It's a lifestyle choice. I'll give me, for example, I happen to live in downtown Austin in a high rise condo.That is a lifestyle choice that I made after I got to a certain, certain point in my life. But this is probably the 12th home I've owned.And so, but if you look at buying an entry level house, maintaining it, watching it appreciate over time, when the time is right, refinance to lower your rate and to lower your carrying costs, that is a formula that has worked for decades and decades and decades in the U.S. and so you don't look at what happens to real estate prices over the course of three years. You look at them over the course of decades. These are long term fixed assets and they should be evaluated as such.And not a, I gotta buy a house so it'll appreciate 25% next year so I can sell it and move up and, and then I can be on the socials with getting the giant key to my next house or whatever.So, so think about it as just a part of your overall investment and, and wealth building strategy, but don't abandon it because it, it still in the overwhelming majority of, of situations has real value and will really impact your net worth over the, over the long haul.

Mike Mills

Well, and that, that brings me to one of the reasons I wanted to have you on too is because I want to know, you know, you guys have done at amplify with your fee free setup that you've, that you've created, which is, you know, when everybody thinks about banking, they're always like, okay, what's my checking account fee? How much do I pay for that? How much do I pay for this?And being a, I believe you said, not for profit institution, being able to implement this, what has that done for your consumers? And then also, you know, what kind of led you guys to ultimately, you know, go in this model when, when nobody else is.

Kendall Garrison

So it's, it's sort of funny. This started as a throwaway idea. We Were in a, we were in a meeting looking at some, some market research.And the market researchers came back and said, well, you know, people don't like to pay bank fees on their deposits. And I said, well, that's not exactly groundbreaking. I hope we didn't spend a bunch of money on this research.

Mike Mills

We did some extensive research and this is what we determined.

Kendall Garrison

Yeah, it's like, great.

Mike Mills

People don't like to be punched in the face. Oh, okay, great.

Kendall Garrison

Oh, who knew this?

Mike Mills

Who knew that?

Kendall Garrison

So I just sort of came up with a few throwaway comment then why don't we just stop charging them? Why don't we just stop charging them? And I make these outlandish statements from time to time.And they thought it was just another outlandish statement that I make. And I said, no, really, what sort of world does it make sense for amplify as an organization to borrow your money as a depositor. Okay.And why do we make you pay? So we can borrow your money. And so if you have a checking account, everyone in the world advertises, we have free checking.But consumers today have been conditioned to realize that free checking ain't free. Okay, if you want to wire transfer money to buy your house, guess what they're going to charge 25 bucks.If you accidentally have an NSF, guess what they're going to charge you 25 bucks. If you want a paper statement, they're going to charge you five bucks. If you, if you.There are some of them I've seen where if you open an account and then close it within 90 days, they charge you 50 bucks. And so what, what sort of world does this make sense?Now, if you want to come to me and borrow the money that we have from our depositors, that's fair game for me to charge you a fee on that.

Mike Mills

Sure. Okay, will you say something real quick? Because you're, you're right there.But I want you to just go one step further because I, even as a grown adult now, obviously, I know this now, but into my list, let's call late 20s, early 30s, you don't think about how banking works, right? You don't think about how I'm going to open a checking account or a savings account and I'm going to put my money there.And all you think about as a young person in that circumstances, I'm just putting my money in a place where I can do stuff with it, right. Instead of keeping it in my house and putting it in a safe. But you don't really go, okay, well, why does the bank exist?Like, what are they doing with that money?And I don't think people understand that the bank uses your money to lend to other people and therefore you're doing them a service by giving them your money and putting it in their accounts, but yet they all still charge you in order to do that. I don't think people understand that. Or they do, but they don't really resonate.

Kendall Garrison

Yeah.So, you know, the, the overwhelming majority of a financial institution's income comes from net interest margin, which is the difference between what we pay on deposits and what we charge charge on loans. And so that spread is called net interest margin. That's the overwhelming majority of a financial institution's income.But back in the early 80s, a banking consultant from Dallas basically thought up, hey, you know what, we can charge people a fee and pay their checks into the overdraft.So you'll remember back in the day, you would go to a convenience store and there would be like a, a picture of a check, a copy of a check pasted up on the cash register that said, don't accept checks from this guy.

Mike Mills

Right.

Kendall Garrison

Because it was a time period.

Mike Mills

Yeah.

Kendall Garrison

And so that was in the days before they had overdraft protection and that sort of thing. And so we just decided to do it but not charge for it. Yeah. And again, we, we wanted to turn the model on its head.The thing that I say all the time is we're going to change what's wrong, wrong with banking or we're going to die trying. And so we really decided that we were going to do this in a much more consumer and business friendly way.Because again, unsurprisingly, the fees charged on checking accounts disproportionately fall on the people who can least afford to pay them. People of color, young people, people that have less financial education that they receive from their parents. That's who pays these fees.And they're the people who can least afford to do it.

Mike Mills

Yeah, yeah. Well, I mean, it's a great thing that you guys are leading the way in this. And it always takes, you know, it's like this is a bit of a superlative.But, you know, nobody said at any point that anybody was going to make an electric car that worked and could be, you know, pushed through and, and, and yet somehow, you know, the richest guy on the planet figured out how to do it and got past all of the, you know, barriers that the industry itself were pushing back on, oil, et cetera, and was still able to pull it off is our electric cars Perfect. No, I'm not saying that. But what I am saying is that every, every industry has standards in which they operate.In order for them to change, you have to have somebody that's willing to say, I know that's what everybody's doing, but we're going to do something different and here's the direction that we're going to go.So it's admirable that you guys are taking that step because that is, you know, especially for the average consumer on a day to day basis, those little fees matter. It may not sound like much to anybody else, like, well, I don't have overdraft, so I don't care. Well, okay, good, congratulations.Like you're doing a good job. But that doesn't mean that there's not millions of people out there that need that.

Kendall Garrison

So a couple of other points. Number one, we also do that on commercial banking.So if you're, if you're a commercial, if you're a business, you often pay, you're on an account analysis and you pay a maintenance fee of, you know, it can be several hundred dollars a month. And so that actually has real meaning to small and mid sized businesses.And small and midnight mid sized businesses generate 80% of the employment in the U.S. and so we kind of feel like that's a give back to our local economy. And actually we do this all over Texas. It's not just Austin. So anybody in Texas can be, can be a member.But the other thing is we really feel like how you make money is just as important as making money. And so we didn't want to make money off the backs of people who couldn't afford or who could least afford to pay those fees.That just didn't seem like the, that didn't seem like the ethical way for us to run a business.

Mike Mills

Yeah, well, I love it. I think it's great. And I think you guys are, are doing a great job there.And I really, you know, sometimes when we talk economics and we talk tariffs and we talk interest rates, you know, some people are like boring. I'm gonna move on to it. I'd nerd out on this stuff because I, I love it.But so I, I really appreciate the conversation because it's not often I get to, you know, trade. I trade thoughts with someone who understands this stuff as well as you do. So, so I really appreciate your time.I know you're a busy guy and you guys are trying to take over the credit union world, which I greatly appreciate because the more, the more ethical businesses that are trying to help the consumer the better. And knowing you guys are out there doing that is fantastic. So I really appreciate your time today.You know, thanks for hopping on with me and kind of walking through this.Hopefully everybody understands everything a little bit more, or at least, you know, we, we didn't muddy it, muddy the waters any more than they already are. So anything you want to leave us with before we go?

Kendall Garrison

Well, I, you know, what I would suggest to your, to your viewers is that, you know, these may be challenging times in the, in the mortgage business and in the real estate business, but tomorrow's an another day. So, so continue to work hard and continue to do what you do, and, and, and we'll all come through this on the other side.And it's been really great being here. I've appreciated the chat this afternoon.

Mike Mills

Yeah, absolutely. Well, I think that's a great way to leave it, so thank you very much, Kendall. I appreciate your time.Thank you to everybody that stuck with us on this one. And we will see you back again next week. Y' all have a good weekend and try not to die in the heat. Thanks, everybody. Bye. Bye.

Chief Executive Officer Amplify Credit Union

Kendall Garrison is President and Chief Executive Officer of Amplify Credit Union. He has been instrumental in driving growth for the credit union over his 12-year tenure, which has tripled in size over that time to more than $3B in assets under management supported by 200+ employees.

Before Amplify, Garrison held senior management positions with various mortgage and commercial banking institutions over a 40+-year career. These organizations included privately held and publicly traded institutions in Texas, including Franklin Bank, Synergy Mortgage, and Extraco Bank. He also worked as a consultant for the Federal Deposit Insurance Corporation, overseeing entities in conservatorship around the country.

Beyond Amplify, Garrison is active in the Austin community. He currently serves as Treasurer for the Board of Directors of Saint Louise House, a nonprofit that provides housing and support for women-led families seeking to break the cycle of homelessness.